The Shadow Industry of Enterprise Chip Refurbishment

Silicon Valley's most well-kept secret isn't a new startup or a cutting-edge algorithm—it's an underground economy of high-end semiconductor refurbishment that's saving corporations millions. As tech giants push for constant hardware upgrades, a countermovement of specialized engineers is extending the life of enterprise-grade chips through sophisticated restoration techniques. This shadow industry operates in unmarked warehouses and specialized labs, where technicians breathe new life into processors that manufacturers have long declared obsolete. With environmental concerns mounting and supply chains under stress, this hidden sector is quietly reshaping how businesses approach their computing infrastructure.

The hidden afterlife of enterprise processors

The journey of a server processor typically begins with fanfare—benchmark results splashed across tech sites, marketing campaigns touting revolutionary performance—and supposedly ends three to five years later when manufacturers release the next generation. But for an increasing number of corporate data centers, that’s merely chapter one. Behind nondescript doors in industrial parks from New Jersey to Shenzhen, specialized labs are developing techniques to refurbish, recalibrate, and sometimes even structurally repair high-end processors that would otherwise be destined for e-waste facilities.

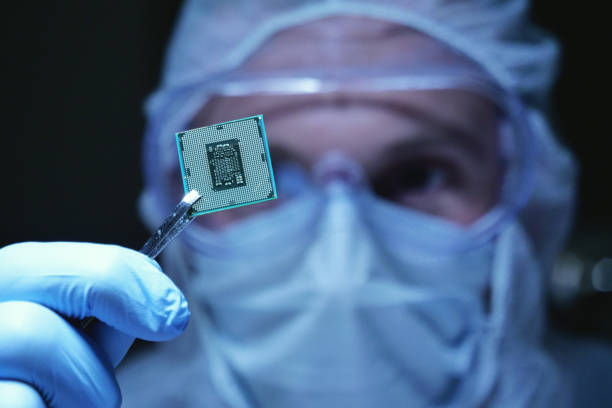

These operations begin with rigorous testing to identify which chips can be salvaged. Using proprietary diagnostic tools, technicians map microscopic faults and performance degradation patterns. The most valuable candidates—typically enterprise Xeon, EPYC, and POWER series processors—undergo multi-stage restoration processes that include physical cleaning using ultrasonic baths, reballing of solder points, and thermal recalibration. The most sophisticated operations even have capabilities to repair damaged interconnects and replace capacitors at the microscale.

“Companies don’t talk about it publicly because there are warranty and support implications,” explains a former semiconductor engineer who now operates a refurbishment facility in the Pacific Northwest, requesting anonymity due to the sensitive nature of his clients. “But when you’re looking at a six-figure saving by extending your server fleet’s lifespan by 18 months, the economics become compelling.”

Corporate demand drives sophisticated techniques

Unlike consumer-grade chip refurbishment—which mainly involves basic testing and cleaning—enterprise-level restoration employs techniques bordering on semiconductor manufacturing itself. The stakes are considerably higher: while a failed desktop processor might cause personal inconvenience, enterprise server failures can cost thousands in downtime per minute.

The most advanced refurbishment operations use equipment repurposed from semiconductor manufacturing, including specialized thermal chambers that can simulate years of operation in controlled environments. These test-and-stress cycles help identify which chips can be reliably returned to service and which have fundamental flaws that make them unsuitable for critical workloads.

What makes this industry particularly remarkable is its development of proprietary techniques to address specific failure modes in high-end processors. Some facilities have perfected methods for repairing microscopic cracks in die substrates, while others specialize in restoring chips damaged by power fluctuations. The most sophisticated operations can even recalibrate thermal sensors and power management systems that degrade over time.

Major financial institutions and cloud providers are among the biggest customers, though they maintain strict confidentiality about these arrangements. One East Coast refurbishment specialist revealed that his client list includes two of the five largest American banks and several government agencies—all seeking to extend hardware lifecycles beyond manufacturer-recommended limits.

Economic drivers behind the shadow market

The financial motivation for enterprise chip refurbishment has only grown stronger in recent years. New server-grade processors can cost thousands of dollars each, with complete server refreshes for large organizations running into the millions. Refurbished chips typically sell for 30-60% of the original price, representing massive potential savings.

Supply chain disruptions have added another dimension to the appeal. When new hardware becomes difficult to source—as happened during recent global chip shortages—the ability to refurbish and redeploy existing assets becomes strategically crucial. Several financial services companies turned to refurbishment during the pandemic specifically because they couldn’t secure new hardware on acceptable timelines.

Market analysts estimate this shadow industry now generates between $2-3 billion annually, despite operating almost entirely through word-of-mouth and specialized broker networks. No major companies publicly advertise these services, and work often happens under strict non-disclosure agreements. The business model typically involves either direct service fees for refurbishment or buy-back arrangements where refurbishers purchase “dead” chips, restore them, and resell them at significant markups.

Technical achievements and limitations

Perhaps most impressive are the technical innovations emerging from this unofficial industry. Refurbishment specialists have developed advanced techniques for diagnosing specific failure points in complex chips that even manufacturers struggle to identify. Some have created adaptive microcode patches that can work around damaged sections of processors, allowing them to continue functioning with minimal performance impact.

The process isn’t suited for every chip or situation, however. Consumer-grade processors rarely justify the expense of advanced refurbishment, and certain catastrophic failures remain beyond repair. High-performance chips with integrated memory controllers or specialized accelerators present particular challenges, as do the newest generations with extreme miniaturization.

“The cutting edge is always a moving target,” notes a technician who specializes in enterprise GPU refurbishment. “Five years ago, we couldn’t reliably repair 14nm node processors. Now we routinely service them, but the 7nm generation presents entirely new challenges.”

Environmental and ethical implications

Beyond the economic considerations, chip refurbishment addresses growing concerns about electronic waste. Server processors contain numerous precious and rare-earth metals, and their production is resource-intensive. Extending useful lifespans through refurbishment significantly reduces environmental impact—something increasingly important to corporations with sustainability mandates.

The practice exists in a complex ethical territory, however. Manufacturer warranties are invariably voided, and some OEMs actively discourage the practice, arguing it introduces reliability risks. Security concerns also emerge, as refurbished chips may lack the latest hardware-level security patches or could theoretically be compromised during the restoration process.

Despite these challenges, the shadow industry of enterprise chip refurbishment continues to grow. As corporations seek both cost savings and sustainability improvements, these specialized technicians offer a compelling alternative to the constant upgrade cycle. Their work represents a fascinating intersection of engineering ingenuity, economic pragmatism, and environmental consciousness—all hidden in plain sight across the technology landscape.